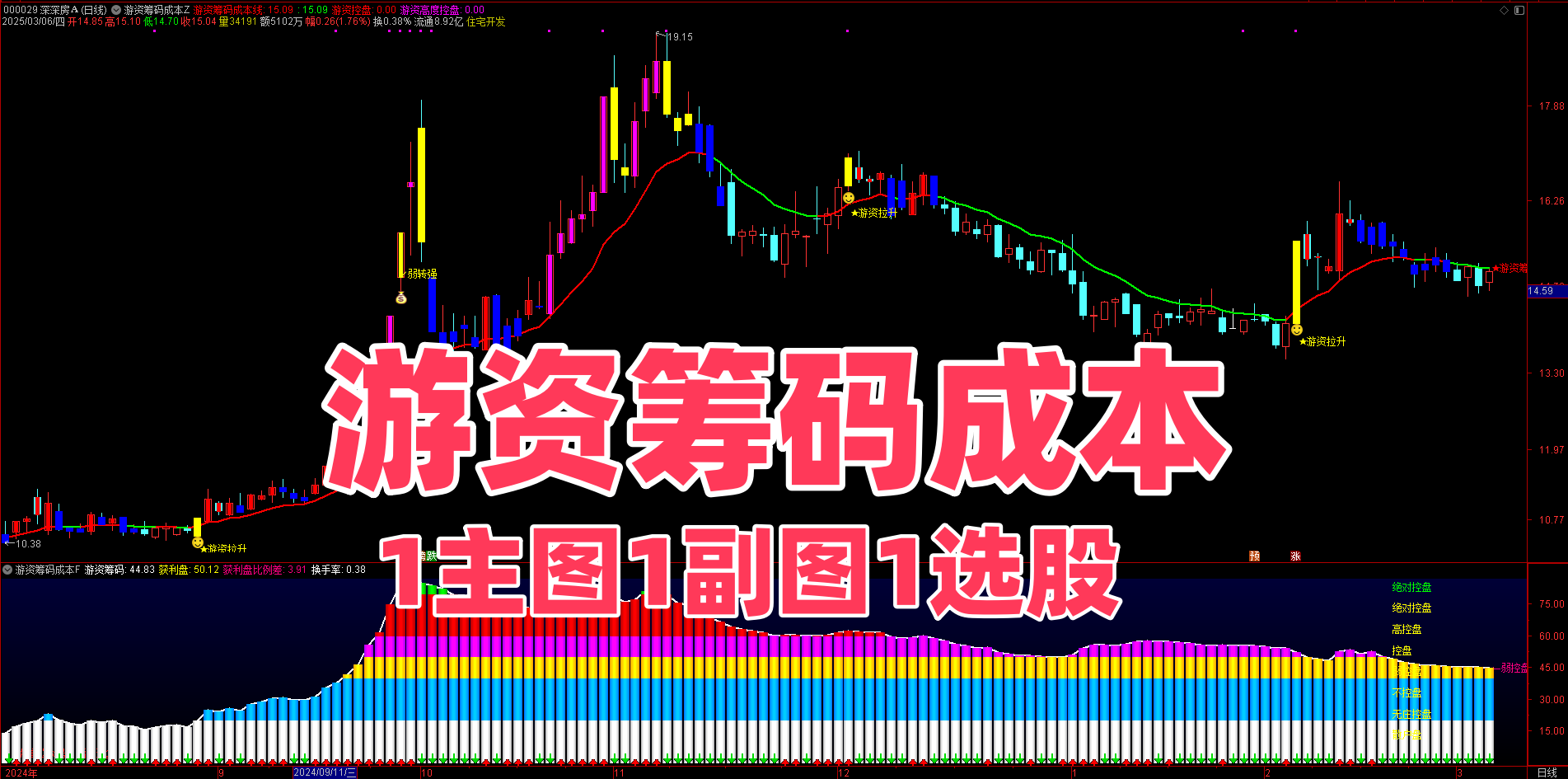

【指标介绍】

指标核心逻辑与信号解读

「爆点启动」工具本质是通过价格、量能、趋势指标的多维共振,识别短期内具备强势动能的形态,其核心优势在于“精准筛选+风险过滤”,拒绝单一指标的片面性,每一个信号都经过多重条件验证,容错率更低。

1. 核心筛选逻辑:三重维度锁定强势形态

该工具并非单一维度判断,而是从趋势、量能、活跃度三个核心层面搭建筛选体系,确保捕捉的强势形态具备持续性。

趋势层面,严格限定价格处于上升结构中,需站稳中期均线,且短期均线形成多头排列,同时价格未偏离中期均线过多,避免过度透支动能。这一设定从根源上排除了处于下行趋势中的反弹形态,锁定真正的强势结构。

量能层面,摒弃“唯量能论”,既要求量能达到有效支撑,证明资金参与度充足,又限定量能不出现异常放大,规避资金短期出逃风险。同时通过累计量能监测,排除短期内量能过度消耗的形态,确保后续动能充足。

活跃度层面,通过监测近期价格波动幅度,筛选出活跃度适中、上涨动能稳定的标的,既要求具备较强的短期上涨能力,又限定下跌幅度和频率,保证形态的稳定性。

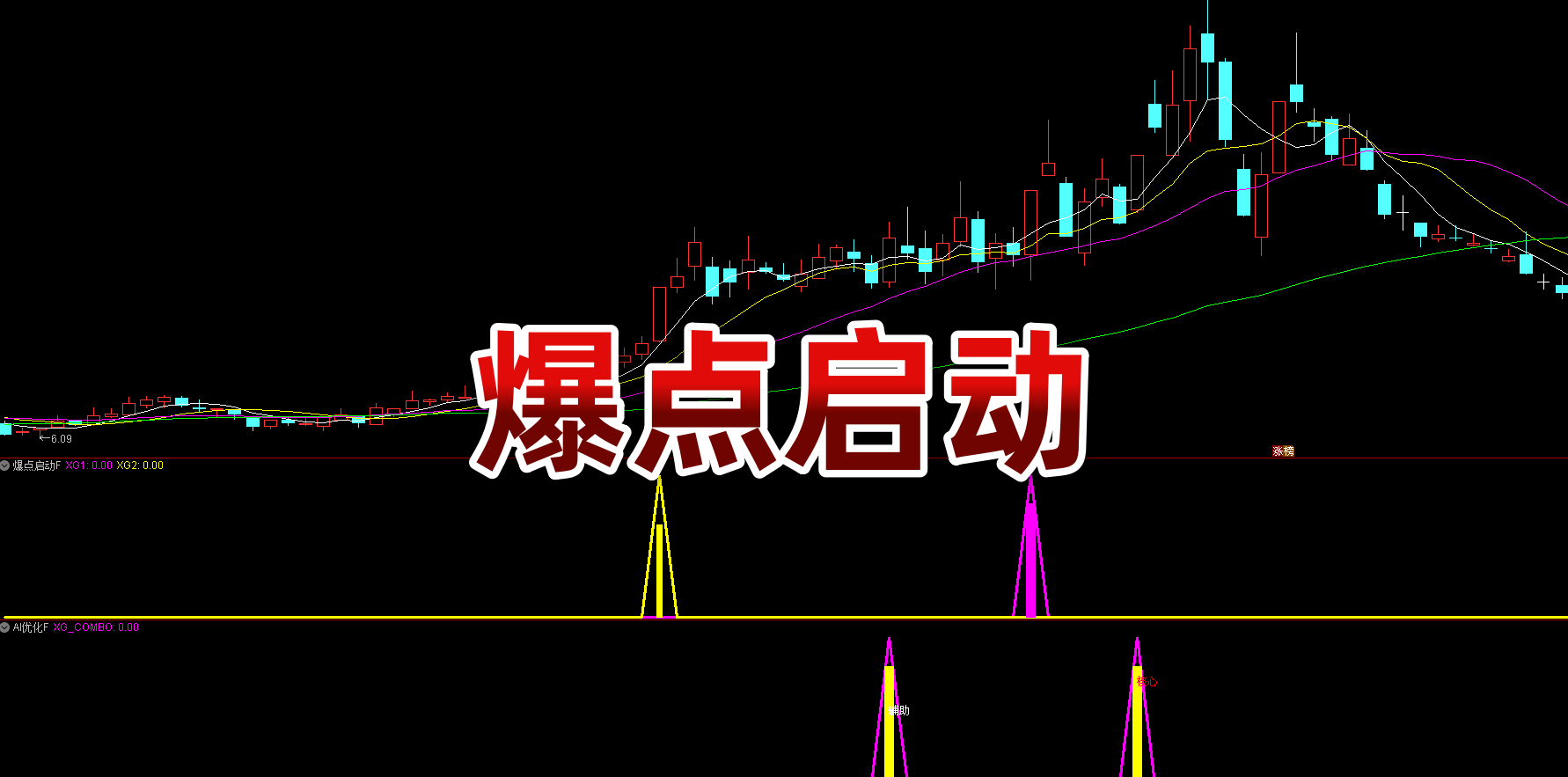

2. 信号分类与解读:核心信号vs辅助信号

工具会生成两类信号,分别对应不同的动能强度,需结合市场环境灵活应对,避免盲目跟进。

核心信号(红色标注):属于高确定性信号,出现时意味着标的同时满足“强势价格突破+量能匹配+趋势共振+活跃度达标”四大条件。此时价格往往形成短期高点突破,且量能、均线、MACD指标形成多维共振,短期动能充足。应对技巧:可在信号出现后,等待回调至短期支撑位附近关注,同时结合实时量能变化,若回调时量能萎缩,支撑有效度更高。

辅助信号(白色标注):属于中等确定性信号,价格上涨幅度略低于核心信号,但同样满足趋势、量能等核心条件,仅在突破强度上稍弱。应对技巧:适合稳健型使用者,需进一步观察后续1-2个周期的形态确认,若后续能维持量能、站稳关键位置,再考虑关注;若出现量能萎缩、价格回落,需及时放弃。

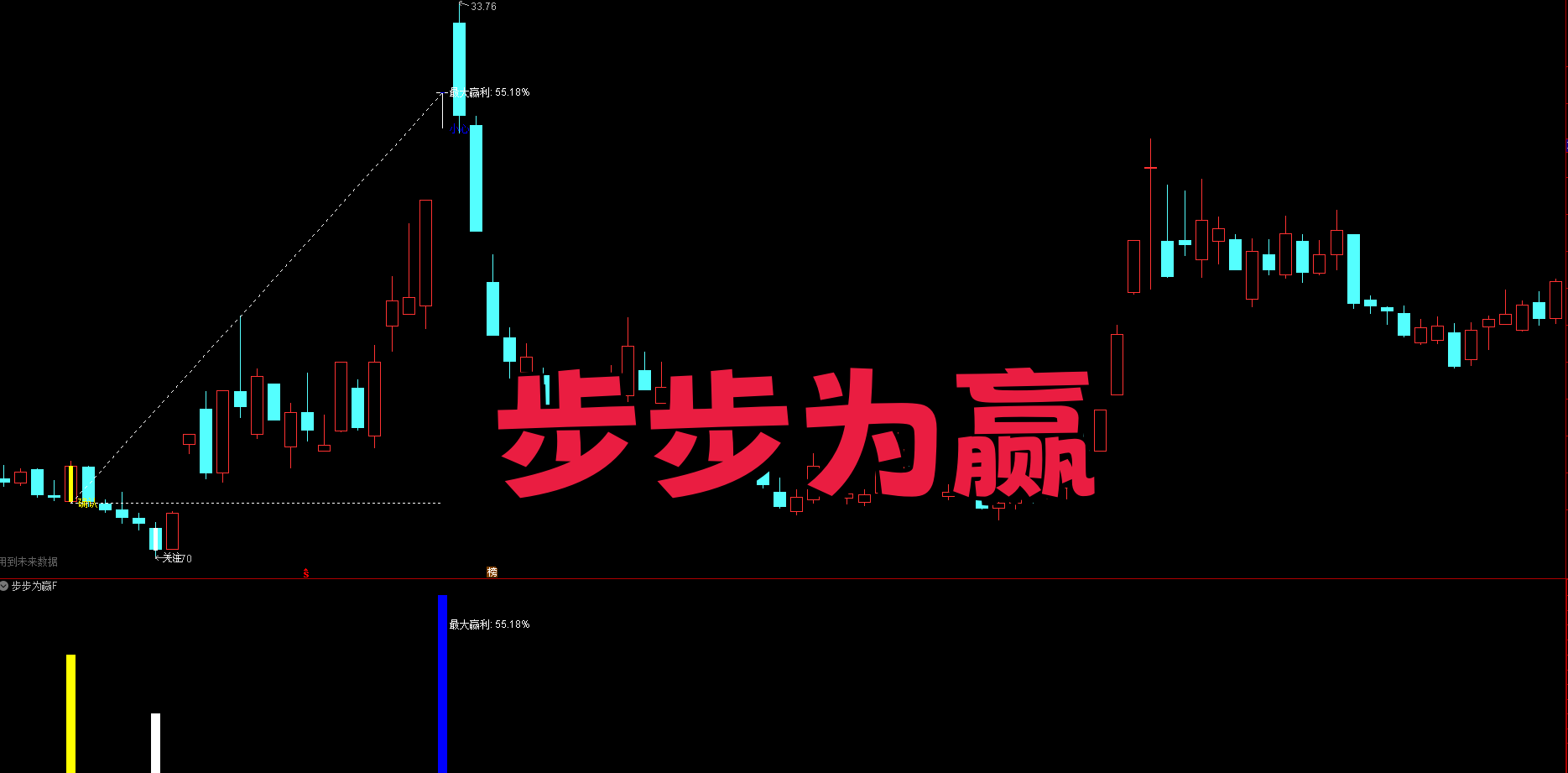

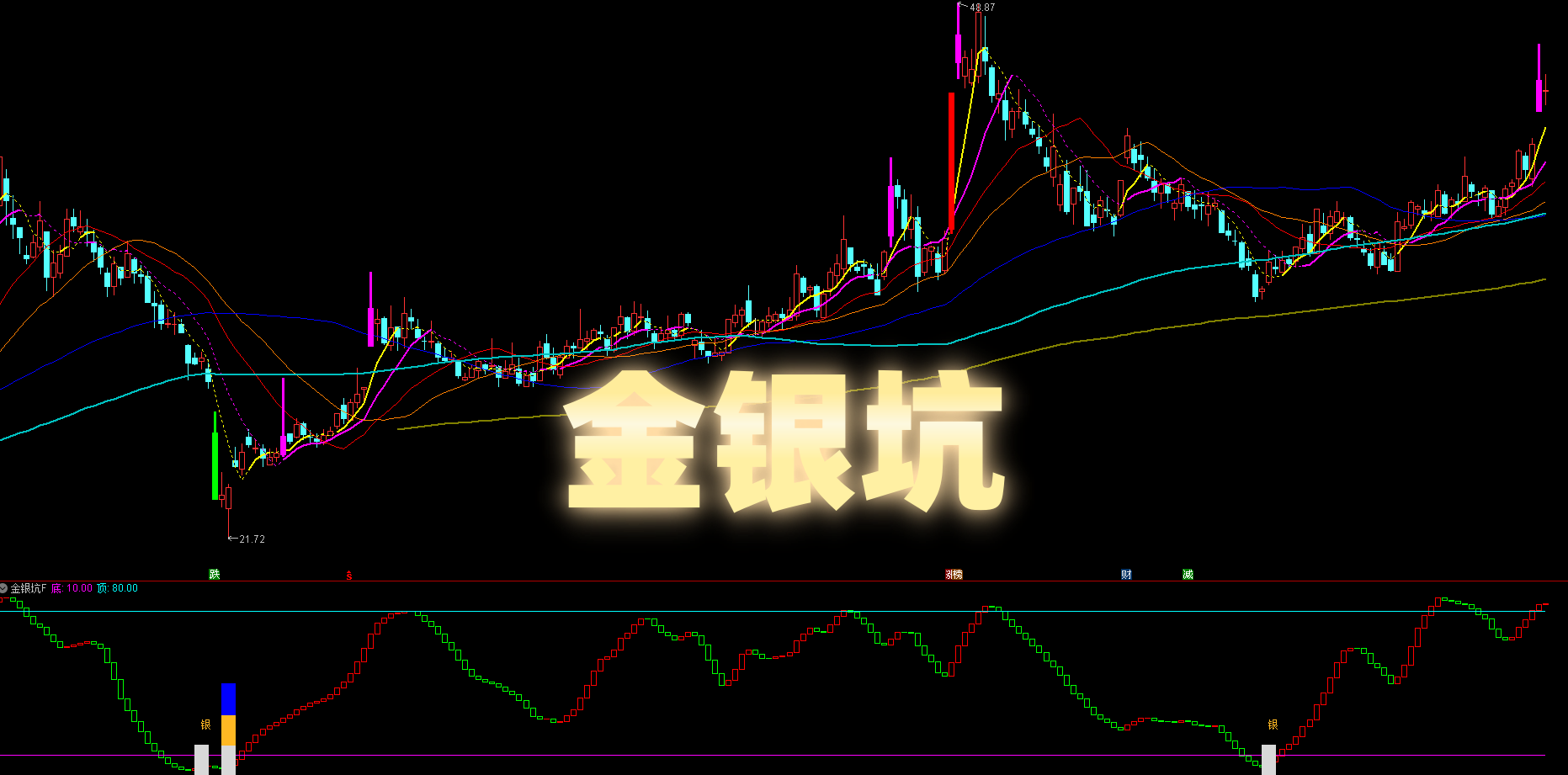

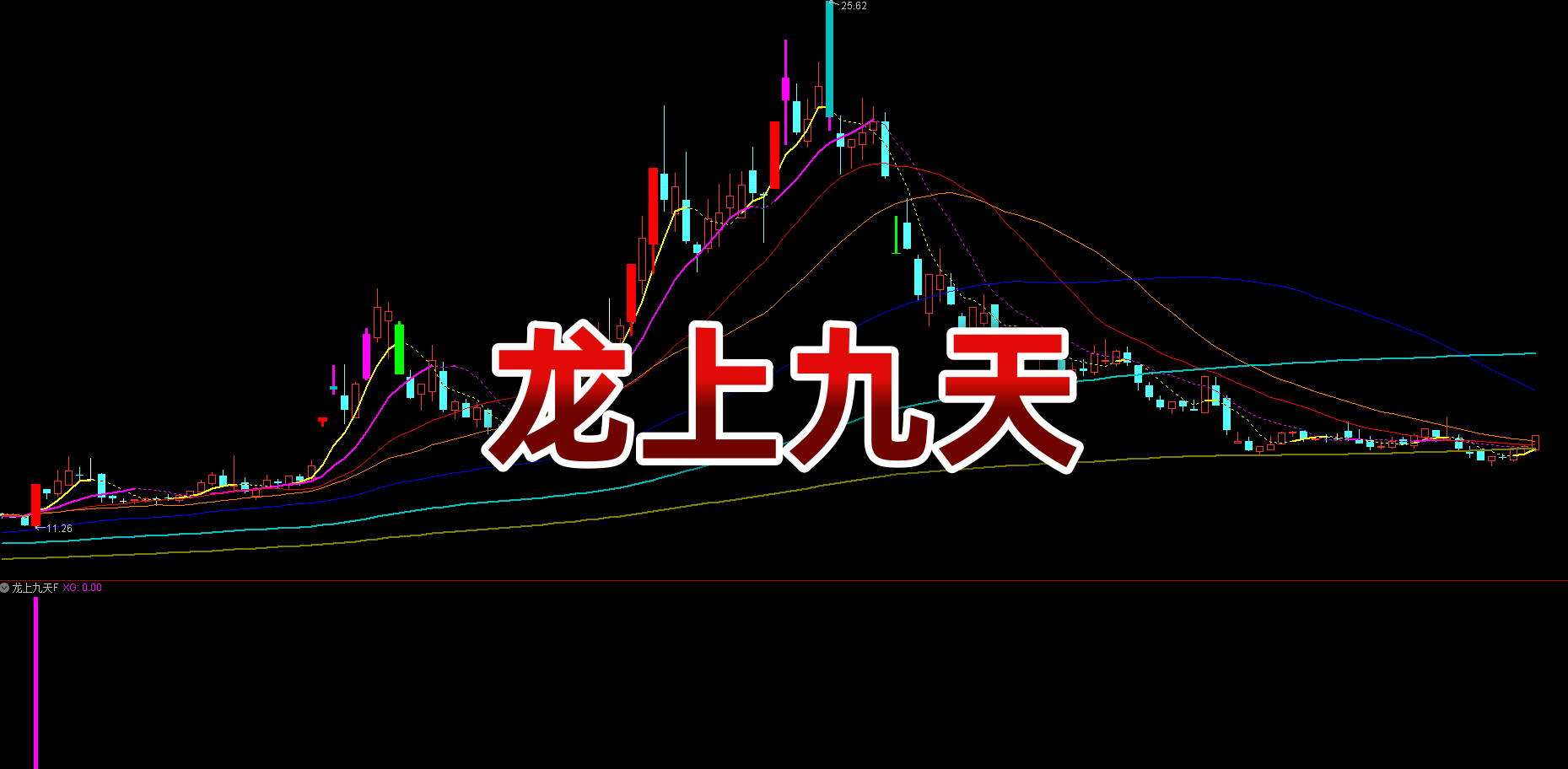

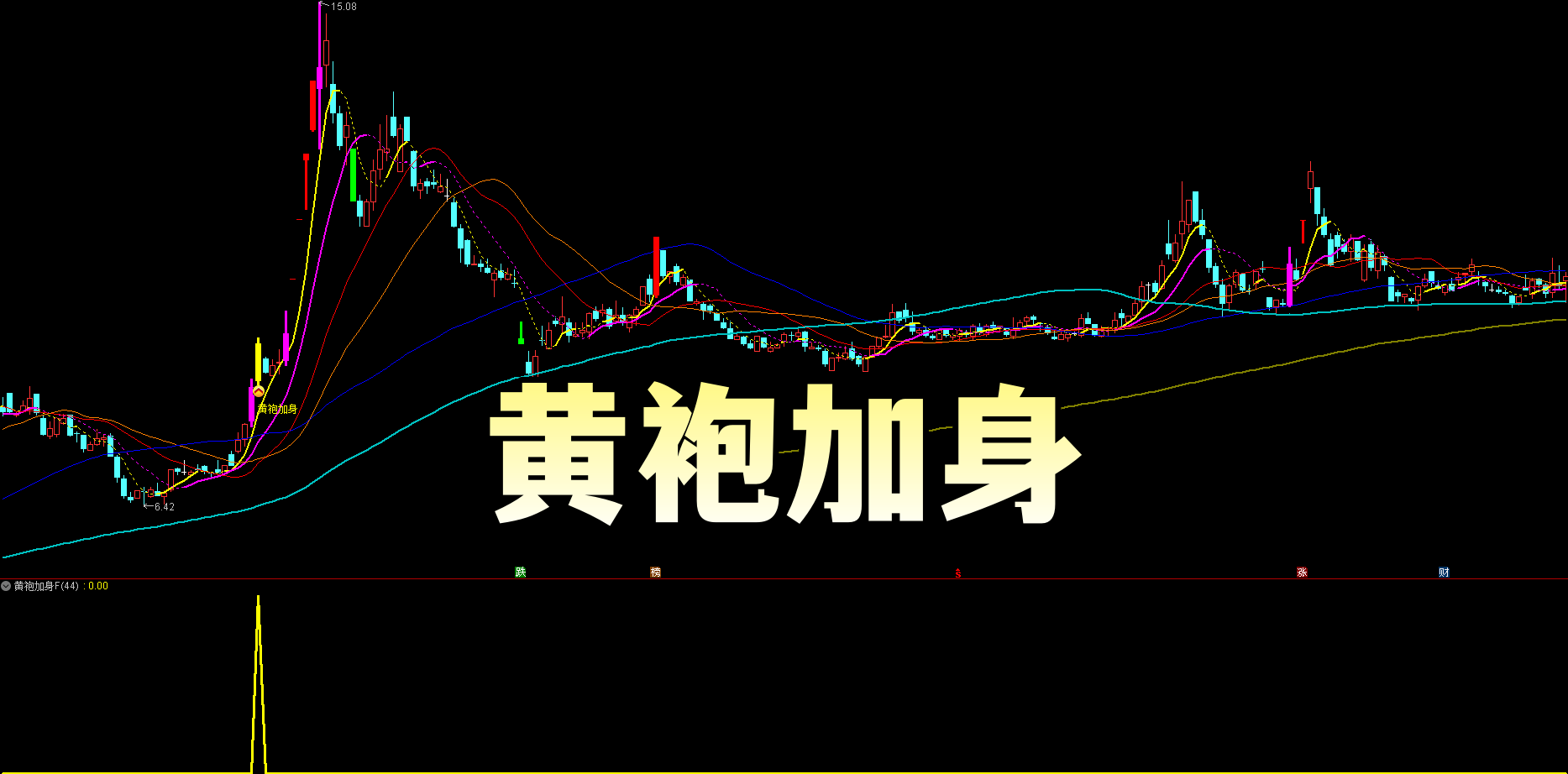

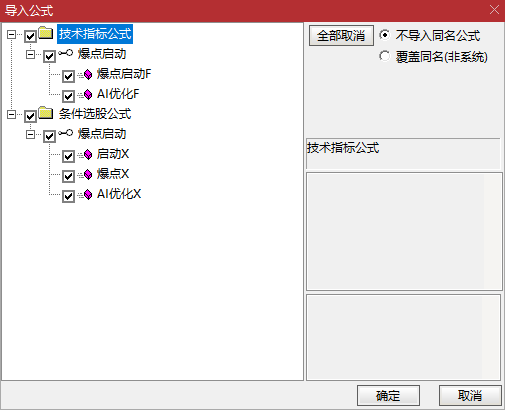

【指标图示】

【指标源码】

{AI优化副TU}

MACD_DEA:="MACD.DEA"(12,26,9);

AF:=MACD_DEA<=0.6 AND MACD_DEA>=-0.3;

PRICE_HIGH:=C>=HHV(C,25);

PRICE_MA:=C>MA(C,20) AND MA(C,5)>MA(C,10) AND MA(C,10)>MA(C,20);

PRICE_RAN:=C<MA(C,20)*1.15;

RISE_9:=C>=REF(C,1)*1.099;

RISE_7:=C>=REF(C,1)*1.07 AND NOT(RISE_9);

TURNOVER:=100*V/(FINANCE(7)/100);

SUM_TURN:=SUM(TURNOVER,10)<450;

VOL_CTRL:=V<REF(V,1)*1.8 AND V>MA(V,5)*0.8;

ACTIVE_CNT:=COUNT(C>=REF(C,1)*1.09,30)>=2 AND COUNT(C<REF(C,1)*0.91,30)<=1;

SUPPORT_L:=EMA((H+L+C)/3,10);

SUPPORT_CH:=O<SUPPORT_L AND C>SUPPORT_L;

DATE_VALI:=DATE<=REF(DATE,0);

CORE_COND:=RISE_9 AND AF AND PRICE_HIGH AND PRICE_MA AND PRICE_RAN AND SUM_TURN AND VOL_CTRL AND ACTIVE_CNT AND DATE_VALI;

ASSIST_COND:=RISE_7 AND AF AND PRICE_HIGH AND PRICE_MA AND SUPPORT_CH AND SUM_TURN AND DATE_VALI;

XG_COMBO:FILTER(CORE_COND OR ASSIST_COND,12) COLORMAGENTA LINETHICK3;

STICKLINE(XG_COMBO,0,0.8,2,0),COLORYELLOW;

DRAWTEXT(XG_COMBO AND RISE_9,0.7,'核心'),COLORRED;

DRAWTEXT(XG_COMBO AND RISE_7,0.5,'辅助'),COLORWHITE;

{爆点启动副TU}

ZB:="MACD.DEA"(12,26,9)<=0.6;

ZB0:=C>=REF(C,1)*1.099 AND C< MA(C,20)*1.16 AND C>MA(C,20) AND ZB AND C>=HHV(C,20);

ZB1:=(C-REF(C,1))/REF(C,1)*100>=9 AND H>L;

ZB2:=REF(EMA((H+L+C)/3,10),1);

ZB3:=EMA(HHV(H,10),3);

ZB4:=EMA(LLV(L,10),3);

ZB5:=EMA(ZB2*2-ZB4,3);

ZB6:=DATE< 1290920;

ZB7:=DMA(C,V/CAPITAL);

ZB8:=(C/REF(C,1)-1)*100>9;

ZB9:=(C/REF(C,1)-1)*100< 40;

ZB10:=100*V/(FINANCE(7)/100);

ZB11:=SUM(ZB10,10);

ZB12:=(C-REF(C,1))/REF(C,1)*100;

ZB13:=REF(ZB12,1);

ZB14:=ZB11< 500 AND O< ZB5 AND C>ZB5 AND V< REF(V,1)*1.9 AND ZB8 AND ZB9 AND ZB6 AND COUNT(ZB1,30)>=2;

XG1:FILTER(ZB14,10),COLORMAGENTA LINETHICK3;

ZB15:=(MA(C,5)-REF(MA(C,5),1))/MA(C,5)>0.015;

ZB16:=C>=REF(HHV(H,30),1);

ZB17:=C>REF(C,1)*1.07;

XG2:(ZB15 AND ZB16 AND ZB17),COLORYELLOW LINETHICK3;

STICKLINE(XG1,0,0.8,2,0),COLORMAGENTA LINETHICK3;

STICKLINE(XG2,0,0.65,1.2,0),COLORYELLOW LINETHICK3;

{AI优化选GU}

MACD_DEA:="MACD.DEA"(12,26,9);

AF:=MACD_DEA<=0.6 AND MACD_DEA>=-0.3;

PRICE_HIGH:=C>=HHV(C,25);

PRICE_MA:=C>MA(C,20) AND MA(C,5)>MA(C,10) AND MA(C,10)>MA(C,20);

PRICE_RAN:=C<MA(C,20)*1.15;

RISE_9:=C>=REF(C,1)*1.099;

RISE_7:=C>=REF(C,1)*1.07 AND NOT(RISE_9);

TURNOVER:=100*V/(FINANCE(7)/100);

SUM_TURN:=SUM(TURNOVER,10)<450;

VOL_CTRL:=V<REF(V,1)*1.8 AND V>MA(V,5)*0.8;

ACTIVE_CNT:=COUNT(C>=REF(C,1)*1.09,30)>=2 AND COUNT(C<REF(C,1)*0.91,30)<=1;

SUPPORT_L:=EMA((H+L+C)/3,10);

SUPPORT_CH:=O<SUPPORT_L AND C>SUPPORT_L;

DATE_VALI:=DATE<=REF(DATE,0);

CORE_COND:=RISE_9 AND AF AND PRICE_HIGH AND PRICE_MA AND PRICE_RAN AND SUM_TURN AND VOL_CTRL AND ACTIVE_CNT AND DATE_VALI;

ASSIST_COND:=RISE_7 AND AF AND PRICE_HIGH AND PRICE_MA AND SUPPORT_CH AND SUM_TURN AND DATE_VALI;

XG_COMBO:FILTER(CORE_COND OR ASSIST_COND,12);

{爆点选GU}

ZB:="MACD.DEA"(12,26,9)<=0.6;

XG:C>=REF(C,1)*1.099 AND C< MA(C,20)*1.16 AND C>MA(C,20) AND ZB AND C>=HHV(C,20);

{启动选GU}

A1:=(MA(C,5)-REF(MA(C,5),1))/MA(C,5)>0.015;

A2:=C>=REF(HHV(H,30),1);

A3:=C>REF(C,1)*1.07;

XG:(A1 AND A2 AND A3);